1. Our Algorithmic Overlords: Since it hasn't featured for a few weeks, I'm going to lead with our old friends this week. If you're in development circles, you know about Aadhaar. And if you're a reader of the faiV you know about China's intrusive citizen monitoring and control (let's dispense with calling it a "social credit score"--this apologia for what's happening is frightening in its own right). But did you know that Venezuela is on the forefront of assigning every citizen an ID and tracking their behavior, including their votes (maybe)? Here's a Twitter thread with some additional details from the reporter of that piece. Guess who's providing the technology?

The frightening frontier in the US is from private technology companies, well, let's be honest, the frightening frontier is Facebook. Here's a New York Times investigation of the company's conduct that is jaw-dropping, over and over again. Where is Teddy Roosevelt when you need him? For now, we've got Kara Swisher's thoughts on cleaning up the "toxic smoke".

Tying the domestic and global back together, here's Susan Liautaud of CGD on how the perspective on the ethics of automation and AI may look different in developing countries.

2. Development Finance and Banking: Sticking with CGD, here's the polymath of development, Charles Kenny, on reforming the World Bank's Private Sector Window to comply with, y'know, the World Bank's guidance on appropriate design for private sector subsidies.

The big question for development finance (and social finance of all sorts) is whether it is crowding-in or crowding-out private sector investment, or neither. Here's Paddy Carter on the "Elusive Quest for Additionality" (have to love a shout-out to old school Bill Easterly) in summary form and in full length paper form (with van de Sijpe and Calel).

Let's say that there is additionality and DFIs are increasing capital flows to developing countries. The next big question is, what impact does that have? Here's Judith Tyson and Thorsten Beck on how those capital flows are affecting domestic financial system development. They conclude that the capital flows are too pro-cyclical and not doing enough to boost domestic capital markets.

There is a specific kind of capital flow that is actively undermining financial development specifically and development in general: regulations on anti-money-laundering and anti-terrorist-financing (regulations are a form of capital right?). Here's a brief from the Humanitarian Policy Group at ODI on how bad it's gotten in humanitarian relief. And just a reminder that this is a pervasive problem. No really,it's a pervasive problem.

Speaking of financial system development, here's an interesting post on what is happening in Ghana's banking sector--well, what's happening is consolidation, the post explains why and what's next. And here's a perspective on the liquidity crunch for Indian NBFCs.

3. MicroDigitalFinance: It feels like we might be hitting an inflection point on mobile money services, the point where it's no longer possible to talk about it without prominently noting the negatives. CGAP has a new report on digital credit in Kenya and Tanzania, which leads them to the conclusion that "It's Time to Slow Digital Credit's Growth in East Africa." Late payment and default rates are enough to make any MFI executive faint. One particularly interesting tidbit: loans taken in the morning are much more likely to be repaid than loans taken at night. That's not really surprising but it's amazing to have that level of insight. Of particular concern is that many borrowers don't understand the terms of the loans they are taking. All the progress made on consumer protection for MFIs doesn't matter much if the market shifts to getting credit elsewhere.

Week of November 5, 2018

1. Household Finance: One of the trips keeping me busy was to Mexico City for the PRONAFIM conference. Here's a video version of my current thinking on household finance, in Spanish.

Of course, one of the key questions in household finance is to what extent a household is a household. I've had a hard time not thinking about this recent paper from Afzal et al, which through a series of "lab in the field" experiments, shows there are a lot of schisms in the household. Let me just quote from the abstract: "Subjects are often no better at guessing their spouse's preferences than those of a stranger, and many subjects disregard what they believe or know about others' preferences when assigning them a consumption bundle." Is there some explanation there for the puzzle in the Graphic of the Week (see below?).

In the household finance realm I often pick on financial literacy--specifically as a bellweather for evidenced-based policy (if money is going into financial literacy, evidence isn't making a dent on policy). Here's some interesting new evidence on financial literacy and why it doesn't seem to work, from Carpena and Zia. They are looking for what parts of financial education might affect behavior, and find attitudes matter more than awareness or numeracy. I feel like that connects to this new paper from Gine and Goldberg documenting endowment effects in account choice in Malawi, and that the endowment effect can be overcome with experience, but maybe not.

2. Inequality: Teaching a class on wealth inequality and policy makes anything on the topic grab my attention just a bit more. And there is a lot out there. On the downside, there's a lot out there and my attention is drawn to all of it. Here's a handy Twitter thread guide (and in a perhaps easier to follow/read format) to the global inequality literature that I found very helpful. Here's a new paper from Ayyagari, Demirguc-Kunt and Maksimovic calling into question the idea that a group of "star" firms are pulling away from others and boosting inequality. You probably already know about this, but the Chetty team has published their Opportunity Atlas. And here's a recent paper from Card et al. on the role of school quality in transmitting economic inequality in the US during the 20th century (in digest form here).

3. Our Algorithmic Overlords: Nothing particular profound here but I couldn't resist pairing these two pieces together: a) "China’s brightest children are being recruited to develop AI ‘killer bots’" and b) A list of artificial intelligence programs that do "what their creators specify, not what they mean." I suppose since the actions of the AI programs sound a lot like children trying to annoy their parents, China's approach seems optimal?

Week of October 15, 2018

1. China: This is a very meta way of kicking things off, but I do think often of the gaps in knowledge that go along with the language gap between centers of academic inquiry and China (and to a lesser extent, India, Indonesia and Nigeria). It takes a lot of cognitive work to push back against the unconscious equation of value/quality with English-language facility, and that's just for the papers and stories that ever do appear in English (thank goodness for Jing Cai!). Anyway, here's a small attempt to address some of the knowledge gap.

The P2P lending industry in China continues to melt down in very scary ways, and in ways reminiscent of bank runs in the US around railroad bubbles in the late 19th century. The common ingredients--a working class population with enough income to start seriously saving and limited outlets for saving/investing and even more limited consumer protections. It's ugly and getting uglier as the authorities crack down on both the lenders and protestors who have lost their savings.

But that's not the only credit market problem in China. The head of a very large state-backed lender was pushed out of the party for corruption (and he's not the first and likely not the last). Meanwhile, local governments have been creating weird vehicles to borrow via private (or are they public? it's hard to know what's the right phrase to use when it comes to China's hybrid economy) markets. Current estimates suggest there is a $5.8 trillion dollar local government credit problem. Amidst the trade war, the Chinese economy seems to slowing just at the time these credit market problems are coming to light--I don't see anything in these stories about a causal effect--and there are other signs of bad news. If you are a Planet Money listener, you may recall a recent story about a rumored "vast postal conspiracy" that largely checked out. This week the Trump administration announced that it is withdrawing from the Universal Postal Union, a system that was set-up for the US' benefit post-WWII but became a huge boon to small Chinese manufacturers. Planet Money's "The Indicator" also did a series recently on China's social credit scoring system, including talking with someone who has been blacklisted.

Finally, here's a story to lead us into the next item: accusations of racism by Chinese firms are becoming increasingly common in Kenya and other African countries were China has been investing heavily.

2. Global Development: The gap (particularly the growth gap) between high-income and low-income countries is what the field is all about, indeed "it's hard to think about anything else." The gap has been stubbornly high and growing since World War II. Dev Patel, Justin Sandefur and Arvind Subramanian have a new post at CGD, reacting to a new paper about the lack of convergence, pointing out that cross-country convergence has been happening since 1990. The authors of the paper respond on Twitter.

There's a curious connection that back when many of the original ideas of development economics posited that convergence should happen--e.g. poorer countries should grow faster than richer ones--while recognizing that it wasn't happening, one of the prescriptions was a "big push" to help poor countries escape a poverty trap. The idea of the big push eventually went into hibernation, but was revived around the time that the convergence did start happening (though we didn't know it yet). This time the big push was at the village level, not the country level. It didn't work any better there. Last week, the results of "the first independent impact evaluation" of Millenium Villages Project (of a village in Ghana) were released and the bottom-line is scathing. There was no gap-closing here--the only positive effects found, the study notes, could have been accomplished at dramatically lower cost. On a similar note, here's a look at another MVP-project village, Sauri, Kenya, and finding that locals did not believe in the benefits of MVP enough to bid up the prices for land in the village. Which honestly is kind of remarkable given all the money that was showering into the villages. You would think people would want to move there simply to benefit from the opportunities for corruption/patronage.

Finally, here's a really fascinating example of a growing gap--the gap in gender preferences grows with economic development and gender equality. This definitely feels like an "everything is obvious once you know the answer" example.

Week of September 24, 2018

1. Poverty and Inequality Measurement: How do you measure poverty, and by extension, inequality? Given how common a benchmark poverty is, it's easy to sometimes lose sight of how hard defining and measuring it is.

Martin Ravallion has a new paper on measuring global inequality that takes into account that both absolute and relative poverty (within a country) matter--for many reasons it's better to be poor in a high-income country than a low-income one, which is often missed in global inequality measures. Here's Martin's summary blog post. When you take that into account, global inequality is significantly higher than in other measures, but still falling since 1990.

The UK has a new poverty measure, created by the Social Metrics Commission (a privately funded initiative, since apparently the UK did away with its official poverty measure?) that tries to adjust for various factors including wealth, disability and housing adequacy among other things. Perhaps most interestingly it tries to measure both current poverty and persistent poverty recognizing that most of the factors that influence poverty measures are volatile. Under their measure they find that about 23% of the population lives in poverty, with half of those, 12.1%, in persistent poverty.

You can think about persistence of poverty in several ways: over the course of a year, over several years, or over many years--otherwise known as mobility. There's been a lot of attention in the US to declining rates of mobility and the ways that the upper classes limit mobility of those below them. That can obscure the fact that there is downward mobility (48% of white upper middle class kids end up moving down the household income ladder, using this tool based on Chetty et al data). I'm not quite sure what to make of this new paper, after all I'm not a frequent reader of Poetics which is apparently a sociology journal, but it raises an interesting point: the culture of the upper middle class that supposedly passes on privilege may be leading to downward mobility as well.

There's also status associated with class and income. On that dimension, mobility in the US has declined by about a quarter from the 1940s cohort to the 1980s cohort. That's a factor of "the changing distribution of occupational opportunities...not intergenerational persistence" however. But intergenerational persistence may be on the rise because while the wealth of households in the top 10% of the distribution has recovered since the great recession, the wealth of the bottom 90% is still lower, and for the bottom 30% has continued to fall during the recovery.

2. Debt: What factors could be contributing to the wealth stagnation and even losses of the bottom 90% in the US? Just going off the top of my head, predatory debt could be a factor. If only we had a better handle on household debt and particularly the most shadowy parts of the high-cost lending world. Or maybe it's the skyrocketing amount of student debt, combined with bait-and-switch loan forgiveness programs that are denying 99% of the applicants. I'll bet the CFPB student loan czar will be all over this scandal. Oh wait, that's right, he resigned after being literally banned from doing his job.

Week of September 17, 2018

1. MicroDigitalFinance: A few weeks ago I wrote that small-dollar short-term loans have always been the bane of the banking industry. We're getting a new test of that. US Bank is launching an alternative to payday loans: loans are between $100 and $1000 and repaid over three months. Interest rates are well below payday lending rates, but still around 70% APR--interestingly on US Bank's page about the loan they very clearly say: "Simple Loan is a a high-cost loan and other options may be available." All of that is good news. But the loans are only available to people with a credit rating (even if it's bad), who have had bank accounts with US Bank for 6 months and direct deposit for 3 months. It will be fascinating to watch take-up, repayment rates, and outcomes--those are where banks have always struggled in this market. Here's Pew's Nick Bourke's take on the US Bank move and the potential for others, with some more regulatory action, to follow suit.

I occasionally remark on insurance being the most amazing invention of all time. It's astounding that it works at all, even in the most developed, trusting and well-regulated markets (see this attempt by one of the US's oldest life insurance providers to collapse the market); it's not surprising that it's a struggle to make it work elsewhere, in the places where households face more risk and would most benefit from access to insurance. So I'm always interested in new work on insurance innovation. Here's a new paper on a lab-in-the-field insurance experiment in Burkina Faso. The basic insight is that many potential purchasers struggle with the certain cost of an insurance premium versus the uncertain payoff. It turns out that framing the premium around an uncertain rebate if there is no payout--which makes both premium and benefit uncertain--increases take-up, especially among those that value certainty most. Yes, you probably need to read that sentence again (and then click on the link to see that even that obtuse sentence is marginally clearer than the abstract). If we want to delve into the details of insurance contract construction, there's also a new paper that delves into how liquidity constraints--a huge factor that hasn't generally gotten enough attention--affect the perceived value of insurance contracts, and how to adjust the contracts accordingly.

And finally, William Faulkner's dictum that "The past is never dead. It's not even past." applies to fintech. A new paper finds that common law countries in sub-Saharan Africa have greater penetration of Internet, telecom and electricity infrastructure, and thus much greater adoption of mobile money and FinTech. That's consistent with history of banking literature that finds common law countries do better on financial system development, financial inclusion and SME lending.

For the record, I've clarified in my own mind the difference between the MicroDigitalFinance and Household Finance categories. The former provides perspective on providers, the latter on consumers. I reserve the right to break that typology as necessary or when it suits me.

2. Household Finance: I suppose another way to distinguish between the two categories is that MicroDigitalFinance features bad news only most of the time, while Household Finance is just all bad news. At least that's the way it feels when I come across depressing studies like this: Extending the term of auto loans (e.g. from 60 months to 72 months as has become increasingly common during this low-quality credit boom) leads to consumers taking loans at a) higher interest rates, and b) paying more for the vehicle. Liquidity constraints mean consumers pay much more attention to the monthly payment and get screwed.

Week of September 10, 2018

1. US Inequality: I talk a lot about congruence between the US and developing countries, but usually in the context of sharing lessons in the financial inclusion domain. But there are other domains where there is a lot more commonality. For instance radically corrupt policing. While this paper has been circulating for awhile, it's worth revisiting over and over again, and it's acceptance for publication is a convenient excuse. US cities and towns, when faced with budget deficits, ramp up arrests and fines of and property seizures from black and brown citizens but not white ones. Here's the easy to share Twitter thread version so you can send it to your not so economics-paper-inclined friends. To be clear, it's only second-order racism. The reason seems to be it's much easier to get away with stealing from people of color because of systemic racism.

Systemic racism like the premium that blacks pay for apartments, a premium that rises with the fraction white a neighborhood is. Lucky that the place you live has little effect on the quality of your education or your future job market opportunities. Oh, wait.

The US is still deeply segregated (cool visualization klaxon) and there has been virtually no progress on that front in decades. Part of the reason is exclusionary zoning which puts a floor on home prices well above the reach of black and brown households. Apparently though, the Department of Housing and Urban Development is planning on tying future grants to cities to cutting zoning restrictions on multi-family dwellings. That would be a rare bright light in the current administration's deregulation push.

2. Cash: I haven't done anything on cash transfers, universal, conditional or otherwise in quite a while. This week we got a flood. I'm going to try to cover the landscape first, before some summary thoughts. Blattman, Fiala and Martinez have an update on their cash grants to youth clubs in Uganda paper--the one that found large gains after four years. After nine years, the controls have caught up. Chris used the analogy of "a tightly coiled spring" as an explanation for why the gains in the first four years were so surprisingly large--and that analogy may still hold. No matter how high the spring jumps, it eventually returns to baseline. Here's Chris's Twitter thread on how his thinking has changed. Here's a Vox article by Dylan Matthews. At this point, if you pay any attention at all, you should expect Berk Ozler to have some thoughts. He does.

Meanwhile, IPA pulled off the greatest unintentional (I'm told by reliable sources--hi Jeff!) mass market advertisement for the release of a development economics working paper in history when the NYTimes Fixes column ran a long-delayed piece by Marc Gunther on using cash as a benchmark for development programs on Tuesday. The paper was being released Thursday. That paper, a comparison of a Catholic Relief Services program to a cost-equivalent cash grant, and a much larger cash grant, by McIntosh and Zeitlin is here. The IPA brief is here. The Vox article is here. And Berk's thoughts (about the Vox coverage really) are here. And Tavneet Suri's. But I'll give Craig and Andrew the last word--here's their post on Development Impact on how they think about the study and the issues.

Week of September 3, 2018

1. Social Investing: Calling out the bland and meaningless rhetoric in social and impact investing almost seems unsporting--it's just too easy but it's Friday after a long week so I'm going to do it anway. Take this piece from John Elkington, who coined the term "triple bottom line," (Please), saying it's time to "rethink" or "recall" or "give up on" it (all his phrases). Why? Because the term has been misunderstood and misappropriated for uses well short of what he intended. Instead he thinks we need "a triple helix for value creation, a genetic code for tomorrow’s capitalism." But apparently not a clear definition or a recognition of trade-offs under scarcity.

Then there's this piece from the Wall Street Journal on the meaninglessness of words like "ethical", "impact" and "sustainable" in the mutual fund world. It's a treasure for the sheer density of laugh out loud snippets. For instance, Deutsche Bank switched out the word "dynamic" in the title of a family of funds and replaced it with "sustainable." Vanguard's bar for a company being "socially responsible" is literally not enslaving people or manufacturing weapons banned by international treaty. But my favorite is probably this quote about buyers of "ESG" funds: "We do hear from investors that have bought funds that they never realized did something." (Protip for non-WSJ subscribers who may not otherwise take the trouble to read this gem, search the title in an incognito window, click on the result link and close the invitation to subscribe and you'll be able to read it.)

2. Household Finance, Part I, Theory: Not realizing that funds did something is a good transition to Matt Levine's musings about the relationship between financial services providers and customers (scroll down to "How much should an FX trade cost?"). Matt is writing specifically about investment and corporate banking but the theory fully applies. In short, 'smart' large customers treat banks like commodity providers and ruthlessly push margins toward zero. Banks have to go along because these are large customers and economies of scale matter in financial services. So the banks make up those margins by charging 'loyal' customers much more than 'smart' customers. Which is, shall we say, not what 'loyal' customers think the banks should be doing and they rightly get very angry when they find out. So loyal customers should be more like smart customers and treat banks like commodity providers. The application of faiV interest is the Catch-22 for lower-income households: they only very rarely have the time and choice to treat financial services like a commodity, so they are almost inevitably left subsidizing wealthier customers. And even banks with good intentions struggle to do otherwise, because if you don't have the large customers, you can't drive costs down through scale.

In other theory news, one of the common motivating theories on helping low-income households is helping them plan. Planning is hard when facing scarcity. There's been encouraging evidence of the value of specific planning for getting people to follow through on their intentions. Here's a new paper testing the value of planning for one of the only two intention-action gaps that can rival the intention-action gap on savings: exercise (the other being dieting). It finds that careful detailed planning of an exercise routine has a precisely zero effect on follow-through.

Finally, here's a piece that at face value seems to be talking about the empirical transition away from cash (in the US). But look closely and it's really musing on the theory about the costs of cashlessness for lower-income households, something that deserves a lot more attention, on theory and empirics, than we seem to be getting right now. And it features Lisa Servon and Bill Maurer so you should definitely click.

3. Household Finance, Part II, Practicum: I don't remember how I stumbled across this paper about how US households respond to high upfront medical costs. It's not new, but it was new to me, though I suppose you can also say it's very old to anyone who has paid attention to healthcare consumption in low-income countries. The authors find a large decrease in spending, but no evidence that households are price shopping or making any differentiation between high-value and low-value services. Something to think about--how much of what we call "shocks" for low-income households are actually "spikes" that they didn't have the tools and bandwidth to manage (liquidity) for?

Week of August 27, 2018

Editor's Note: I'm still playing catch-up this week, and perhaps you are too. It's the "end of summer" in the Northern Hemisphere after all, that week we all get to, in a panic, confront all those things we had put off to the Fall AND all those things we thought we would get done during the "less busy" summer. Catching up notwithstanding, this is a somewhat truncated edition of the faiV, as I head into a weekend of labor related to the above.--Tim Ogden

1. Small Dollar Financial Services: I've been doing a lot of reading the last few weeks about the history of consumer banking (Hi Julia!), and by history I mean going back to the Middle Ages and before. From that reading, it's clear that small dollar lending has always been the bane of the banking system--and there is nothing new under the sun (thanks, David Roodman!). Which certainly colors my view when I see stories about overhauling the overdraft system in the US. Not that I don't think there is room for significant improvement. Overdraft is perhaps the worst possible way to manage small dollar lending--by pretending it's something else while still charging exorbitant fees that would make many microfinance institutions blush. There are plenty of ideas, like this story on a non-profit payday alternative lender which charges roughly half the fees of its competitors. The intent of the story seems to be offering this as a real alternative, but the details keep getting in the way. The nonprofit really is nonprofit in the literal sense of the word, not even being able to pay its CEO a $60,000 per year salary regularly, and facing "four near-death experiences" in 9 years--that sounds about par for the course in small dollar lending from the historical record.

2. Algorithmic Overlords: Yuval Noah Hariri has a new piece in the Atlantic, the title of which is just candy-coated confirmation bias for me, so how could I resist putting it in the faiV: "Why Technology Favors Tyranny". I'm feeling validated that I started reading Asimov's I, Robot to my kids this week. But back to Hariri, two thoughts: a) borrowing a category from Tyler Cowen, this is a very interesting sentence: "At least in chess, creativity is already considered to be the trademark of computers rather than humans!", and b) the picture Hariri paints bears a remarkable resemblance to the Allende plan in Chile specifically, and to almost every example in Seeing Like A State, it's just that the technology is finally catching up to the political ideology. The big question, of course, is whether the technology will yield any better results.

One more item I couldn't resist is this piece about blockchain and supposed complacency toward technological innovation in development. The most important thing to know is that the two examples given of the benefits of a decentralized ledger (e.g. blockchain) are two of the most centralized and highly policed ledgers in existence: SWIFT and Visa payment networks. It continues with a few potshots at small dollar fintech lenders and then some ersatz blockchain evangelism about power to the people. Let's hope the author reads many of the pieces linked above, but especially Hariri's. And just because, here's a story about the very first blockchain hiding in an ad in the New York Times in 1995.

3. Methods and Evidence: You've likely seen the uproar over ridiculous nutrition studies (on alcohol and dairy--clearly the message is to only drink dairy-based cocktails this weekend) this week. I saw someone on Twitter commenting on how the credibility revolution seems to have passed right by nutritional epidemiology, probably because it would mean that no studies ever got published.

Part of the credibility revolution is the emphasis on open data and replication. Here's a report on the latest large scale replication effort (of 21 social science studies published in Nature and Science). Thirteen of the 21 were generally replicated, but the effect size was roughly half of that originally reported. Of course, this raises the question of what "successful replication" means again. Here's a Twitter thread from Stuart Buck of the Laura and John Arnold Foundation on the difficult distinction between failed replication being a part of the scientific learning process and a failed replication as part of identifying shady research and publishing practices.

Here's a troubling story about unreliable administrative data. The US Department of Education asked school districts to start reporting "school-related shooting" incidents. There were 240 reported. But follow-up reporting was only able to verify 11 of those incidents and 161 were explicitly denied. Don't let the emotional subject of school shootings distract entirely from the reminder that there are always problems with data gathered like this, no matter what the subject. And pause for a moment to remember that it is data like this that Hariri fears will be used to automate administrative regimes.

The point of these studies, whether ridiculous nutritional ones, or administrative-data based ones, is most often to influence behavior and policy. Here's Jean Dreze on the challenge of evidence-based policy, and the need for economists "to be cautious and modest when it comes to giving policy advice, let alone getting actively involved in 'policy design.'"

4. Global Poverty: On the topic of evidence-informed policy choices, one of the most hotly debated questions in the field right now is what is happening with global poverty. At face value it seems like this is just a question of going to look at the data. But as with so many other areas, different people see very different things in the data (even if it is accurate). It all depends on how you measure poverty and whether you care more about absolute or relative numbers. There was a glimmer of detente in this debate this week as Jason Hickel and Charles Kenny published "12 Things We Can Agree On About Global Poverty." But that only lasted a day before Martin Ravallion chimed in with this Twitter thread, which begins, "it seems they only agree on the obvious, and ignore some less obvious things that really matter."

If you're looking for another way into these debates and the various issues that arrive, here's a Washington Post story about Nigeria displacing India as home to the largest number of people in absolute poverty. Maybe.

5. Social Investment and Philanthropy: I highlighted a couple reviews of Anand Giridharadas' new book Winners Take All last week. Here's another, from Ben Soskis, which I include because it's the best one yet. The theme of Giridharadas' book (and Rob Reich's new book as well) is being skeptical of the power of large-scale philanthropy or social investment. Here's a thread from Chris Cardona, of the Ford Foundation, on the multitudes contained in the word philanthropy, which is certainly important to take into account when considering the critiques. But the question of who is a philanthropist, who is abusing their power, and the trade-offs of institutionalization of philanthropy are always messy. Here's a story about a viral GoFundMe campaign to help a homeless man in Philly who gave his last $20 to rescue a stranded motorist. If you have Calvinist sympathies like me, you'll probably guess what happened next. Finally, here's Ed Dolan of the Niskanen Center on whether we need the charitable deduction.

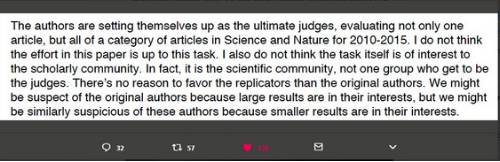

Returning to the topic of methods and evidence-based policy, two images popped up in my Twitter thread this week that I couldn't get out of my head. One is a snippet from a peer reviewer of the social science replication paper highlight above, explaining why it was not published in Nature or Science even though it was replications of papers from those journals. And second is a picture taken from a talk John List was giving this week about his career. You have to ask, does science advance via replication or via funerals? Via Brian Nosek and Ben Grodeck respectively.

Week of August 20, 2018

1. Financial Inclusion and Digital Finance: The last time I was writing the faiV, various takes on the Global Findex data were being featured prominently. So it only seems fitting to come back to that as I return. Greta Bull of CGAP has a two-part blog, part I and part II, reacting to Beth Rhyne's and Sonja Kelly's take (may I take a moment to smile at the inclusion that sentence reveals?) on the Hype vs. Reality of inclusion. Bull argues that the Findex data shows greater progress on inclusion than Rhyne and Kelly see. For what it's worth I lean to toward Bull in this debate. It would be surprising, given the incredibly rapid progress in access, if the access-use gap wasn't growing, especially in countries with relatively low levels or recent gains in access as network effects won't kick in for awhile.

There is another concern beyond the use/access gap--does use of the available accounts make people better off. Here's a new paper from Kast and Pomeranz showing that providing free savings accounts in Chile led to lower debt burdens (and some additional evidence on rotten kin). On the other hand here's an open letter from Anup Signh to Kenyan Central Bank governor Patrick Njoroge making the case for urgent regulatory action on digital credit to protect borrowers. On the third hand (hat tip to Brad DeLong) mobile money seems to have saved lives (note no counterfactuals there, but it seems plausible) during Ebola outbreaks in Liberia and Sierra Leone during Ebola outbreaks by ensuring that response workers got paid.

Of course, benefit depends not just on use, but on who is using the services. Microsave found that 80% of the "addressable LMI market" in India was not being served by fintechs, and, with CIIE's Bharat Inclusion Initiative, has launched a "Financial Inclusion Lab" to help Indian fintech's address that market.

2. Our Algorithmic Overlords: If you've gotten out of the habit of reading the faiV, what better way to grab your attention back than sexbots! Here's Marina Adshade, an economist at UBC, with a thoroughly economic argument about how sexbots could make marriage better (by changing how it works and what it does). And here's Gabriel Rossman, a sociologist at UCLA, making the counterargument. Apparently he reads Justin Fox.

On a much more prosaic, and more urgent, front, there have been a raft of stories on the increasingly alarming situation in Northwest China where the tech-driven panopticon seems to be racing ahead in the service of persecution of Muslims and ethnic minorities. Here is the NYTimes "inside China's Dystopian Dreams". Here's Reuters on the "surveillance state spread[ing] quietly." MIT Technology Review asks, "who needs democracy when you have data?" And here's Foreign Affairs on the "coming competition between digital authoritarianism and liberal democracy." If I have a bone to pick it's the lack of attention to the possibility of "authoritarian democracy" that comes along with a surveillance state and AI overlords.

3. Global Development: If sexbots don't get your attention, what about hyperselectivity of migrants? I think, quite a while ago, I linked to Hicks, et al. on the systematic differences between those who migrate from rural to urban Kenya, and those who stay on the farm, finding that urban productivity is a factor of the traits of the workers who migrate.

Week of August 6, 2018

1. Universal Basic Income (unpopular locale edition): In 2010, to replace massive energy and food subsidies, the Iranian government apparently implemented a cash transfer program that began covering over 95% of the population (75 million people) before targeting seems to have lowered coverage to less than 35 million. The story in two sentences: “In 2011, the first full year of the program, transfers amounted to 6.5% of the GDP and about 29% of the median household income. After three years of inflation, the amount transferred per person is down to less than 3% of GDP per capita.” New research finds minimal effects on labor supply or hours worked, though the short time horizon for the large transfers makes it hard to generalize. I suspect that the short time horizon is only part of the reason this policy hasn’t gotten more attention.

2. Our AI Overlords: Another AI benchmark falls. In a much-publicized practice event Sunday, an AI system developed by OpenAI beat a team of former pros at a mutliplayer video game called Dota (they had a livestream and posted a video that is totally inscrutable to me). This was expected given the rapidly-growing computation devoted to experiments like this, though it looks like the training required by this model (190 “petaflop/s-days,” whatever those are) was less than would be expected from extrapolating past large experiments. (The costs for those experiments are also growing by an order of magnitude every year and a half, which seems… unsustainable.) Apparently OpenAI are planning a Dota match against current pros later this month, so expect to hear more about this.

3. Cryptocurrency (or Weird Household Finance): Apparently “proxies for investor attention strongly forecast cryptocurrency returns,” which seems… a little obvious? And Matt Levine discovers a subculture of people who intentionally participate in pump and dump schemes in marginal cryptocurrencies as a form of gambling, which raises the question - what do the other people investing in marginal cryptocurrencies think they are doing?